Lowe's Credit Center: Finance Your Next Project With Lowe's Credit

Chase Online is everything you need to manage your Credit Card Account. Wherever you travel you'll always know what's going on with your account – quickly and easily. See when charges and payments are posted. Track your spending and view your account activity. 1 Subject to credit approval. The Catherines Rewards Program is provided by Catherines, Inc. Program terms are subject to change. Credit Cardholders are required to open a Catherines Rewards Program Account in order to receive Credit Card member benefits.

Credit Cardholders are required to open a Lane Rewards Program Account in order to receive Credit Card member benefits associated with the Lane Rewards Program. To open a Lane Rewards Program Account, you will be required to provide your phone number and email address to Lane Bryant.

When you need to complete a project in your home or business, the cost of materials can begin to add up quickly. That’s why Lowe’s offers financing options for both personal and business purchases. For personal use, choose the Lowe’s Advantage Credit Card. When it comes to your business, choose between the Lowe’s Business Account Card, the Lowe’s Accounts Receivable Card and the Lowe’s Business Rewards Card from American Express. Lowe’s also offers a PreLoad Card that allows you to use flexible funding from a checking, credit, debit or bank account.

Lowe's Advantage Credit Card

Applying for the Lowe's Advantage Credit Card is quick and easy. You can choose 5% off eligible purchases or orders when you charge to your Lowe's account using your Advantage Card or take advantage of six months special financing on qualifying purchases of $299 or more. And when you use your Advantage Card for purchases of $2,000 or more, you can choose 84 fixed monthly payments at reduced APR financing.

Lowe’s Business Credit Cards

When you choose a Lowe’s Business Credit Card, you have multiple options from which to choose. While each option still allows for 5% off eligible orders and discounted delivery on Lowe’s purchases, there are still major differences to take into consideration before making a decision. A Business Account Card can share a credit line between multiple cards while the Accounts Receivable Card can have multiple authorized buyers (These cards can only be used to make purchases at Lowe’s). Unlike the Accounts Receivable Card and the Business Account Card, the Business Rewards Card from American Express can be used at Lowe’s and everywhere that accepts American Express. Plus you can earn points and rewards that can be redeemed as both Lowe’s and American Express Gift Cards.

Lowe’s makes it easy to manage your credit account. With our easy and secure system, you can manage your account and pay your bill online from anywhere, at any time. Use your Lowe’s credit card login information to access your account and track your purchases or view your statements. If you have any questions about your Lowe’s credit card payment or your account, feel free to use our online account management tool or call our toll-free customer service number for support.

Online Credit Card Philippines

High-profile hacks of enterprise-level companies have, in recent years, thrust the risks of identity theft into the public consciousness. But did you know that half of all credit card fraud is conducted online using spyware? Internet credit card fraud schemes are highly profitable for spyware villains, who steal billions of dollars every year from unsuspecting computer users and corporations.

How Spyware Is Used to Commit Credit Card Fraud

Spyware collects your personal data

Once you encounter spyware and other forms of malware while doing your usual activities online, spyware silently begins collecting your information and wreaks havoc on your computer. Without your knowledge, spyware runs in the background recording your Internet browsing habits and keystrokes, monitoring the programs you use and collecting your personal information. This can lead to serious consequences such as credit card fraud and identity theft.

Spyware villains make money off your information.

Once spyware has sent your personal and financial data to spies, the criminals either sell your information to other criminals or fraudsters impersonate you using stolen information. Sometimes they will attempt to add themselves or an alias that they control as an authorized user to your account so it’s easier for them to use your credit.

Usually, the villains will:

Request new account PINs or additional cards

Make purchases

Obtain cash advances

You pay for the damage spyware has caused.

The extent of the damage of online identity theft varies by case. But, if there's one thing victims can be sure of, it's that their time, money, and peace of mind will all take a hit.

Most credit card fraud victims don’t realize what has happened until it’s too late. Costs that a victim may incur include:

Restoring their credit records

Increased interest and insurance rates due to corrupted credit, health or driving records

Fixing a malfunctioning, spyware-infected computer

Lost productivity

Dmg Pc Online Colorado

How to prevent online credit card fraud

Internet credit card fraud and identity theft can be devastating. Proactively preventing spyware damage is vastly less expensive than paying to restore your credit, your identity, and your computer. If you want to know how to prevent credit card fraud, here are a few things you can do right away:

Use varied and complex passwords for all your accounts

Continually check the accuracy of personal accounts and resolve discrepancies immediately

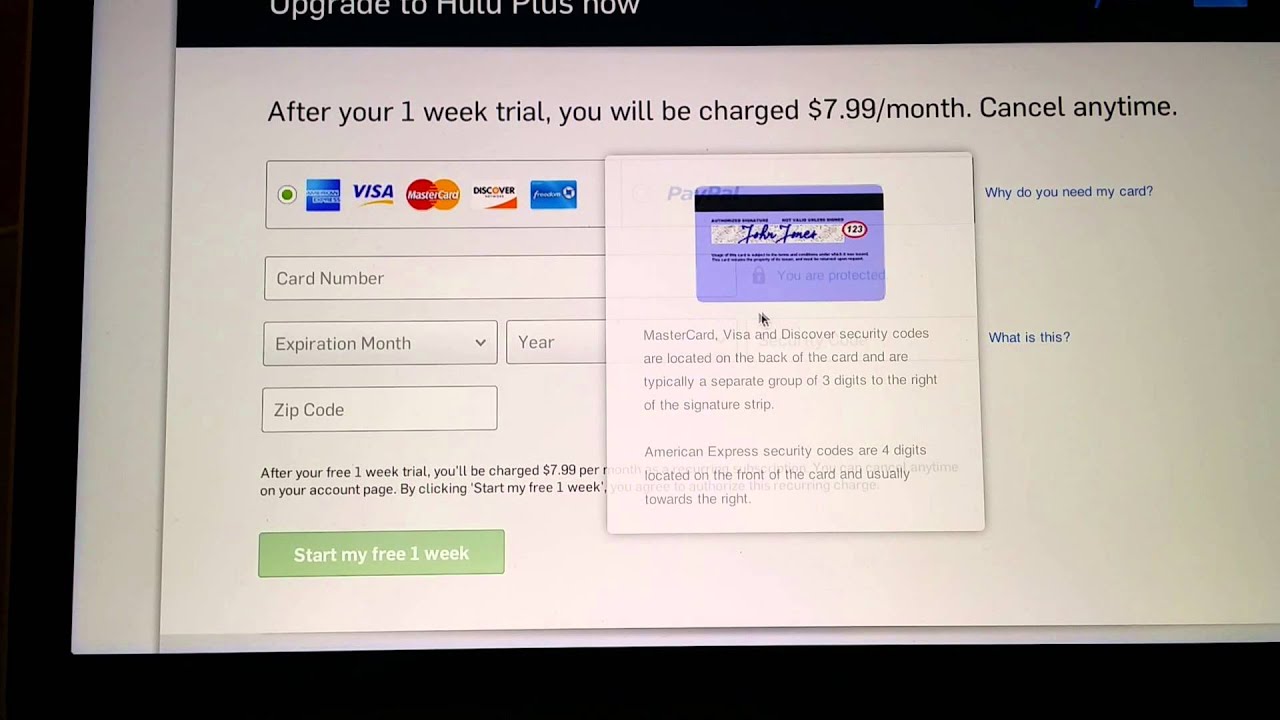

Only provide personal information on sites that have 'https' in the web address or have a lock icon at bottom of the browser

Do not provide personal information to any unsolicited requests for information, which are often a sign of phishing

Avoid questionable websites

Practice safe email protocol:

Don't open messages from unknown senders

Immediately delete messages you suspect to be spam

Only download software from sites you trust. Carefully evaluate free software and file-sharing applications before downloading them.

To avoid credit card fraud, make sure that you have the best security software products installed on your PC:

Use antivirus protection and a firewall

Get antispyware software protection

Dmg Pc Online Credit Card Charge Online

The best internet credit card fraud protection begins by avoiding spyware infection in the first place. Products like Webroot® Internet Security Complete® guard against spyware entering your computer and prevent it from slowing your PC through damage to your files and programs. A good anti-malware program searches every place on your computer where spyware can hide and removes every trace to boost your PC performance. While free anti-spyware downloads are available, they just can’t keep up with the continuous onslaught of new spyware strains. Previously undetected forms of spyware can often do the most damage to your PC, so it’s critical to have up-to-the-minute, guaranteed protection.